How to Use AlgoWay Backtesting with TradingView

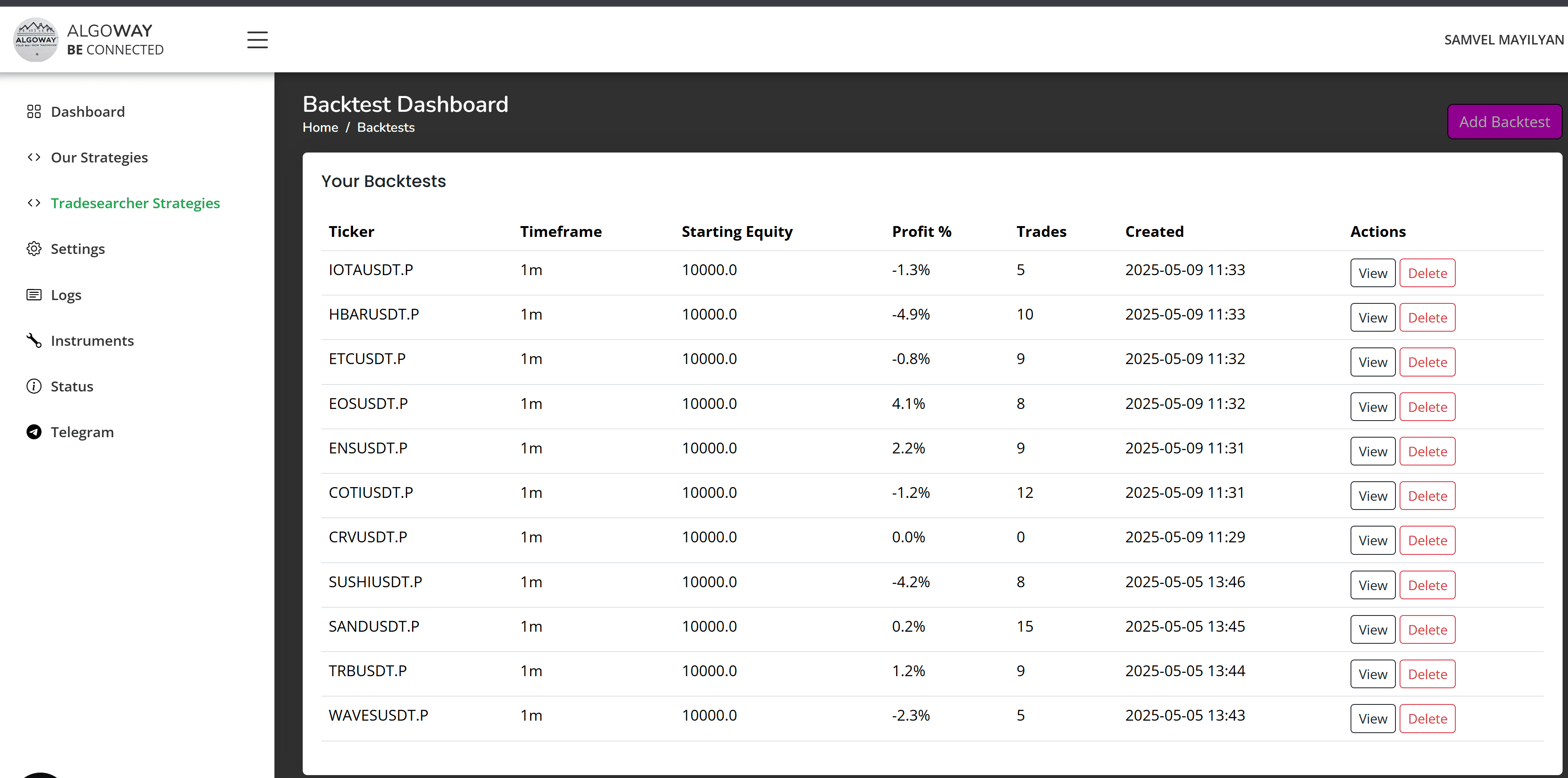

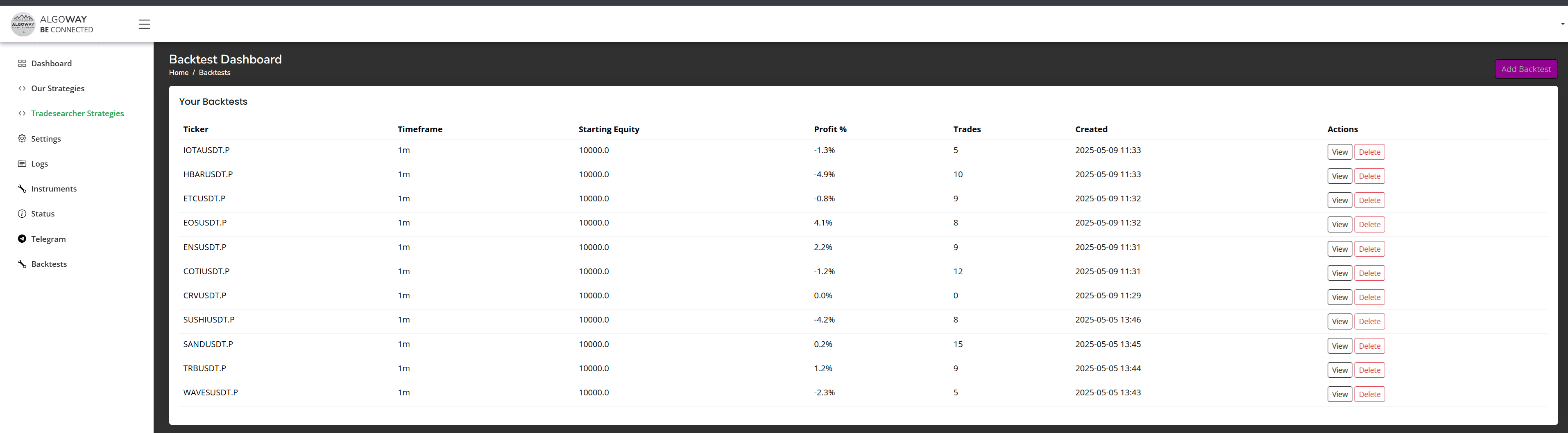

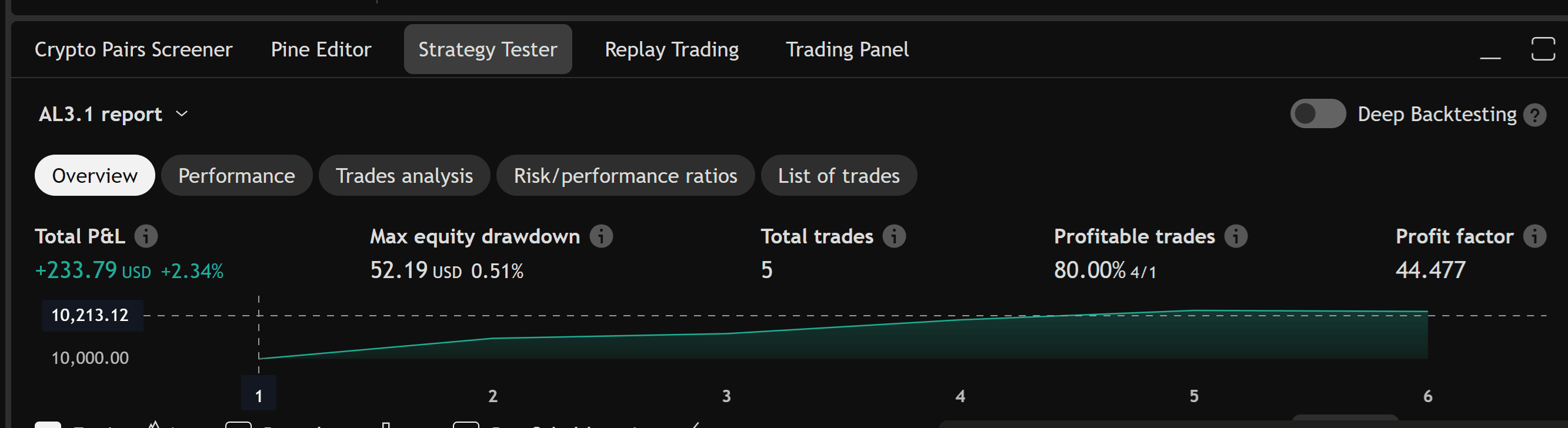

AlgoWay allows you to preserve and extend TradingView backtests. TradingView only keeps 11 days of 1-minute candle history in the strategy tester. That means your strategy results change every day based on shifting sample windows.

This makes it impossible to properly evaluate long-term performance of a strategy. AlgoWay fixes this problem by saving the current TradingView result and letting you track additional trades from that moment onward.

Why TradingView backtest isn't enough?

Today you may see 75% profitable trades — tomorrow it could be 60%. Not because your strategy worsened, but because older profitable trades dropped out of the 11-day window. This leads to unpredictable fluctuations in stats. AlgoWay solves this by fixing today's result and calculating real-time stats from that point on.

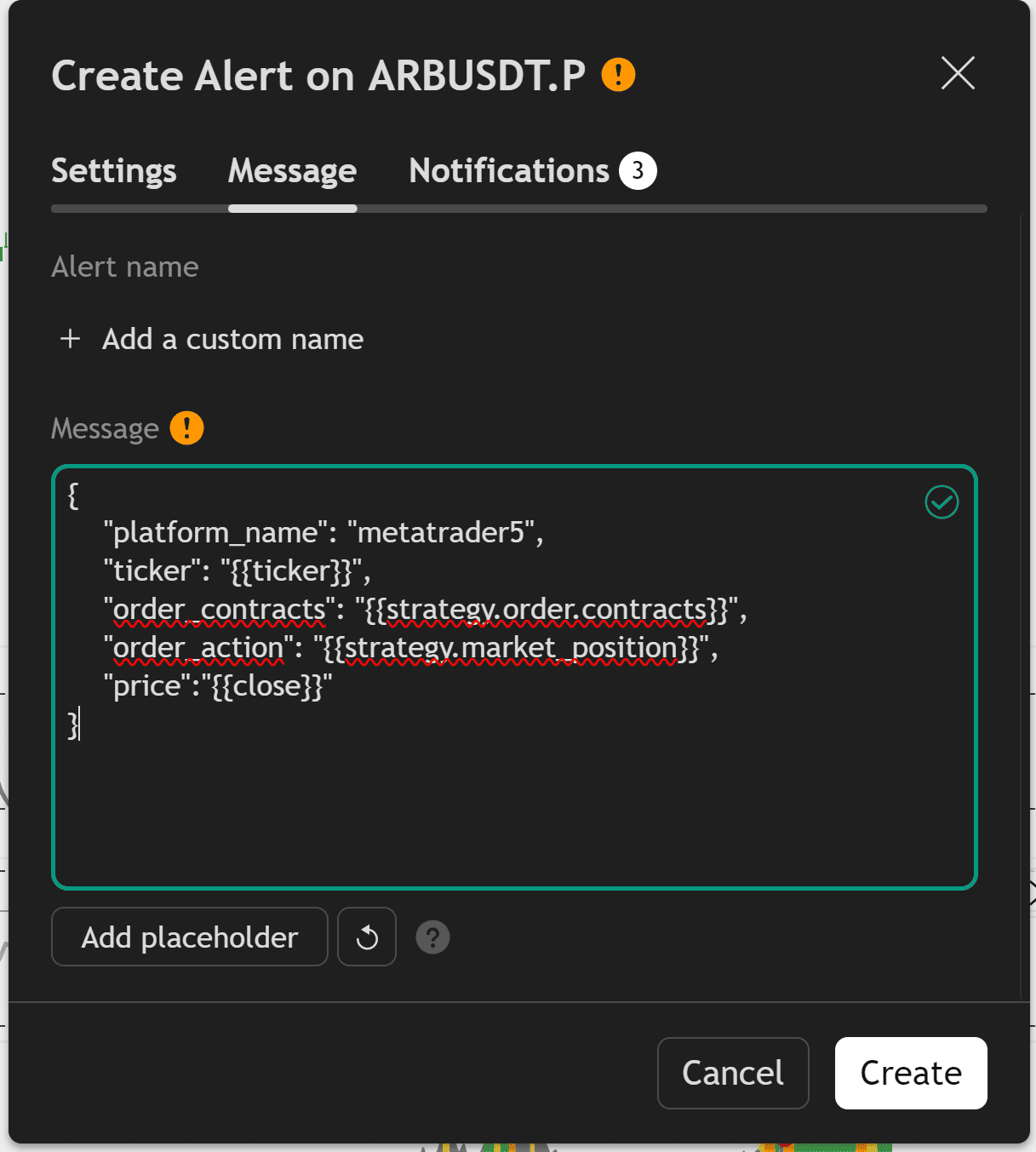

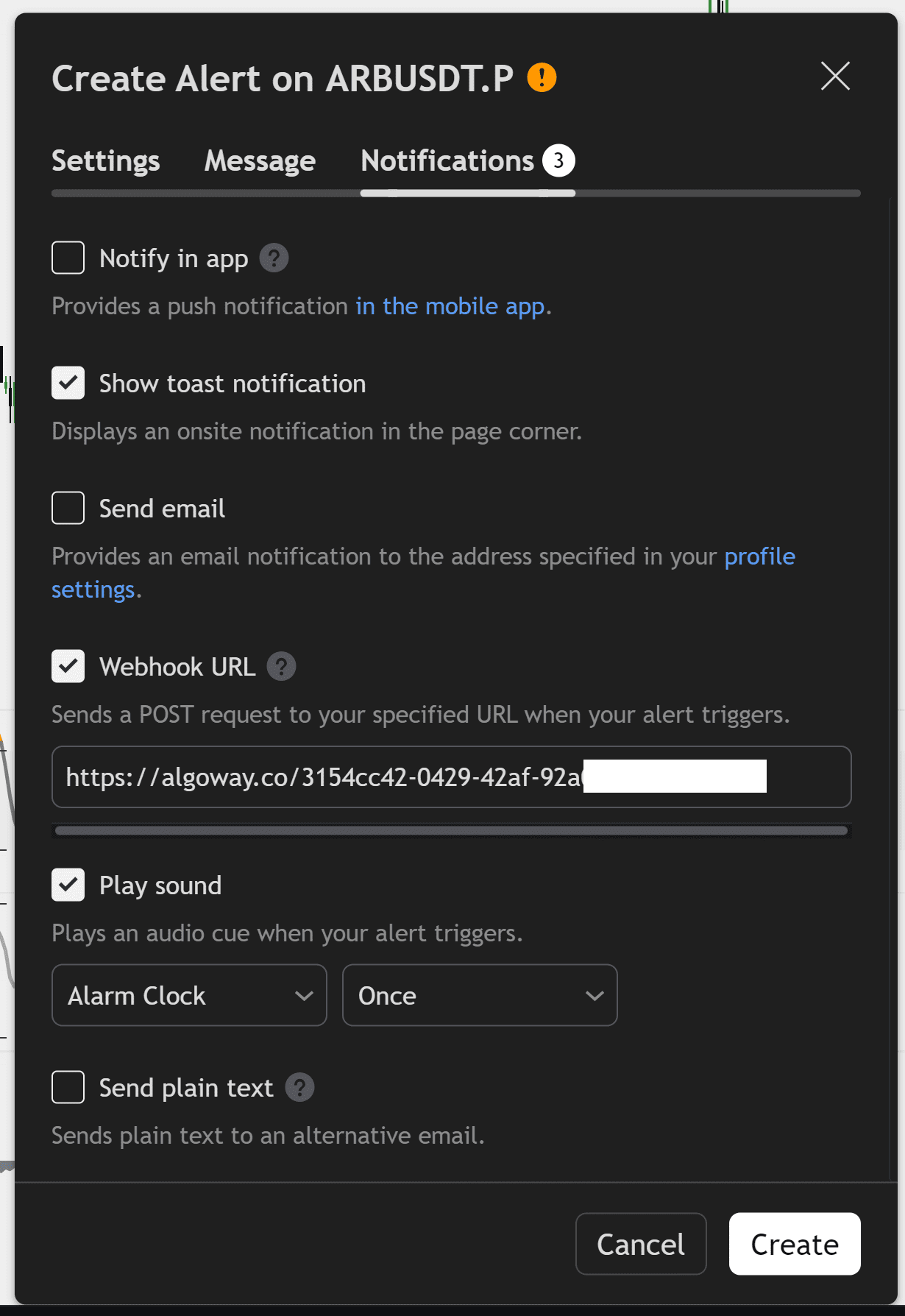

Webhook JSON Format

Here is the required JSON format for TradingView alerts:

{{

"platform_name": "metatrader5",

"ticker": "{{ticker}}",

"order_contracts": "{{strategy.order.contracts}}",

"order_action": "{{strategy.order.action}}",

"price": "{{close}}"

}}

Note: The price field must be added manually. Also, the ticker must exactly match the one used in your AlgoWay backtest, or trades will not be recorded.

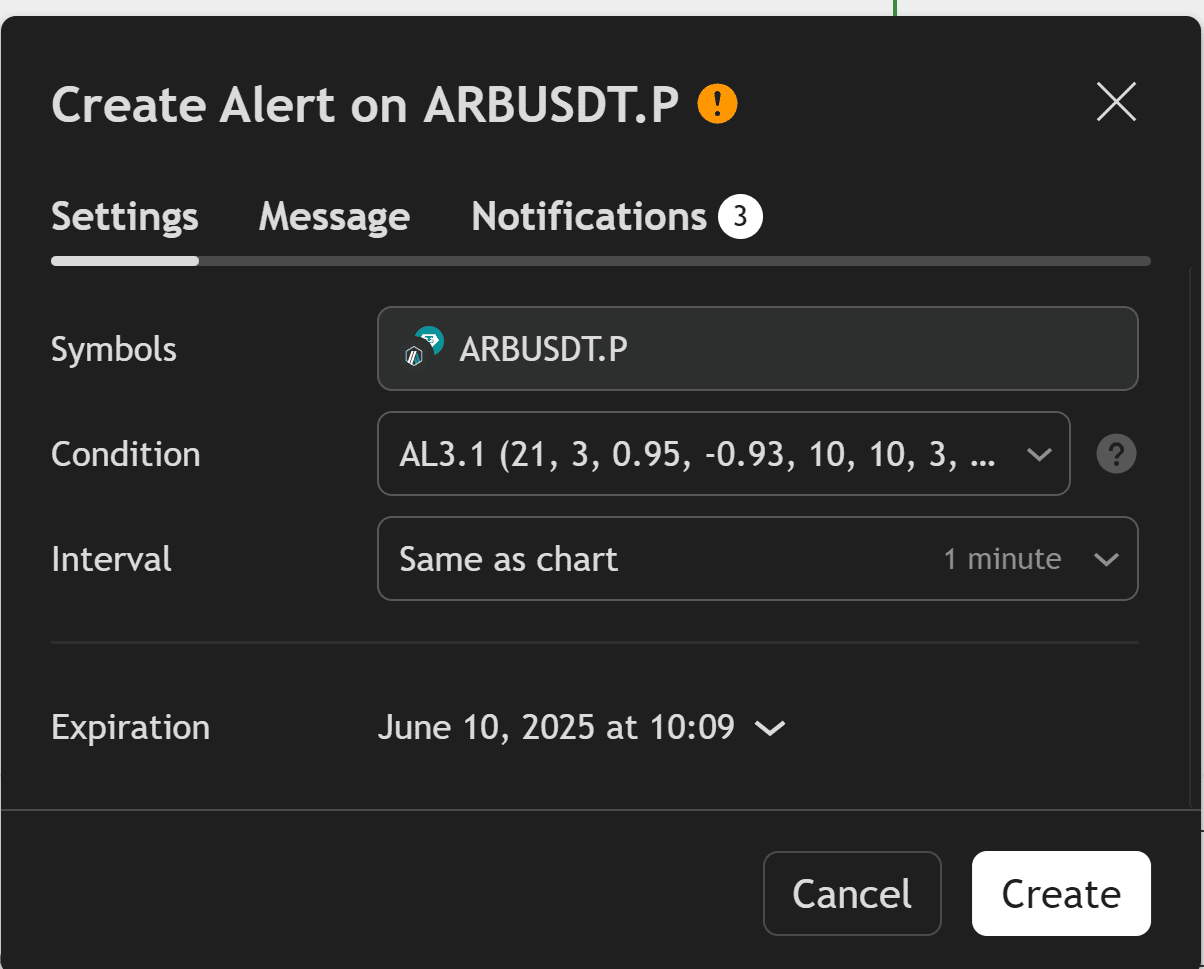

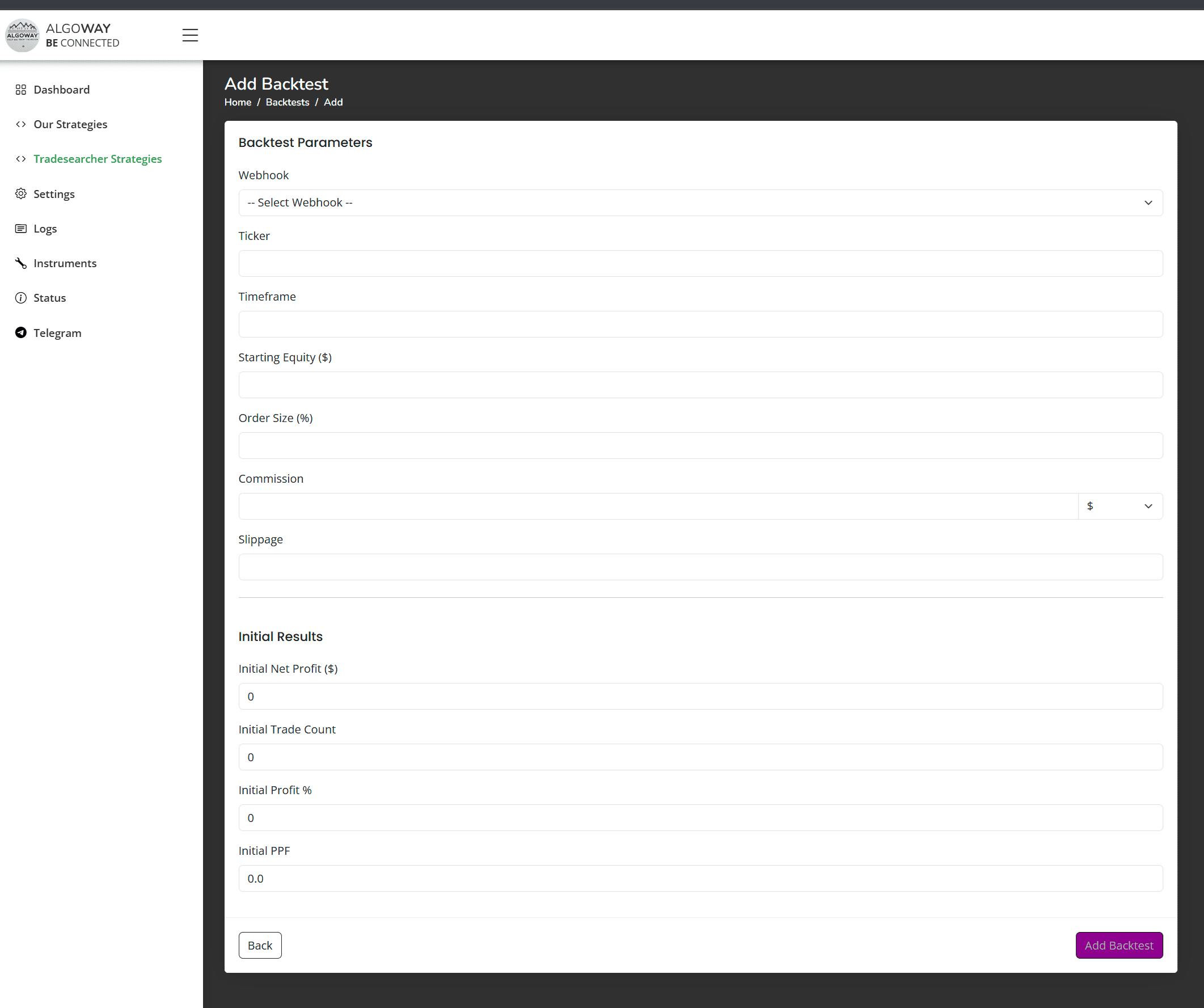

Initial Parameters

You can manually create a clean backtest even without TradingView — simply enter values like equity, commission, slippage, etc. This is useful when starting from scratch or testing theoretical setups.

Accuracy of Results

The numbers in AlgoWay may slightly differ (1–3%) from TradingView due to rounding, slippage, and commission calculation differences. This is expected and does not affect the overall outcome.

Conclusion

AlgoWay backtests are not just copies of TradingView reports — they are enhanced, fixed snapshots that let you truly measure performance beyond the limitations of the 11-day candle window. This is critical for 1-minute and short-term strategies.